Life Insurance Partners

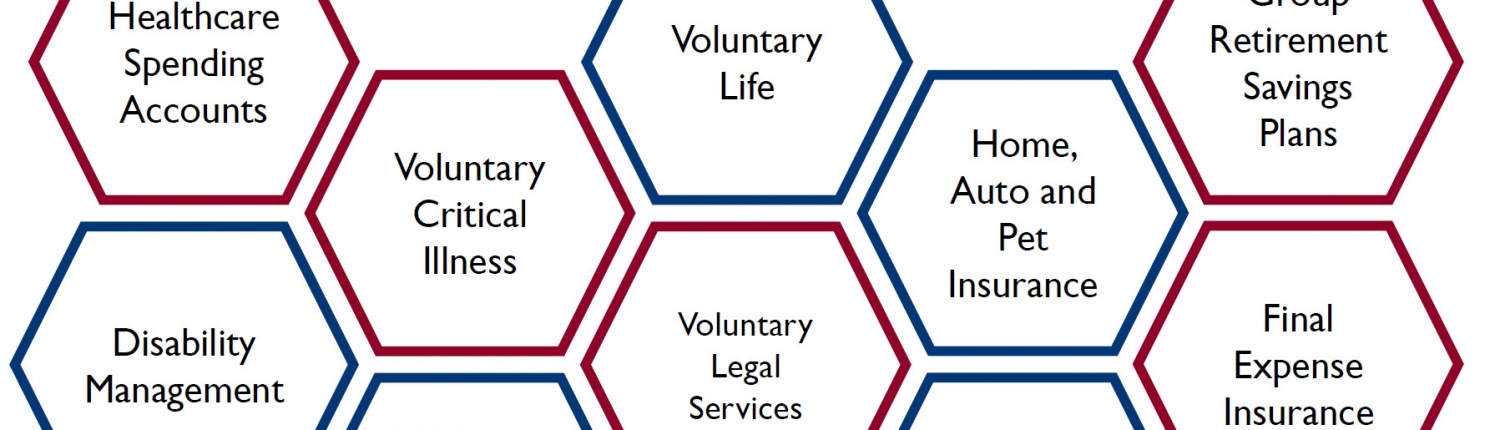

Our network of Life Insurance partners puts us in a position to manufacture and distribute segregated fund model portfolios that allow our advisors to leverage existing client relationships by expanding the scope of products and service offerings and also attract new clients through a broader range of services.

Portfolios Of Segragated Funds

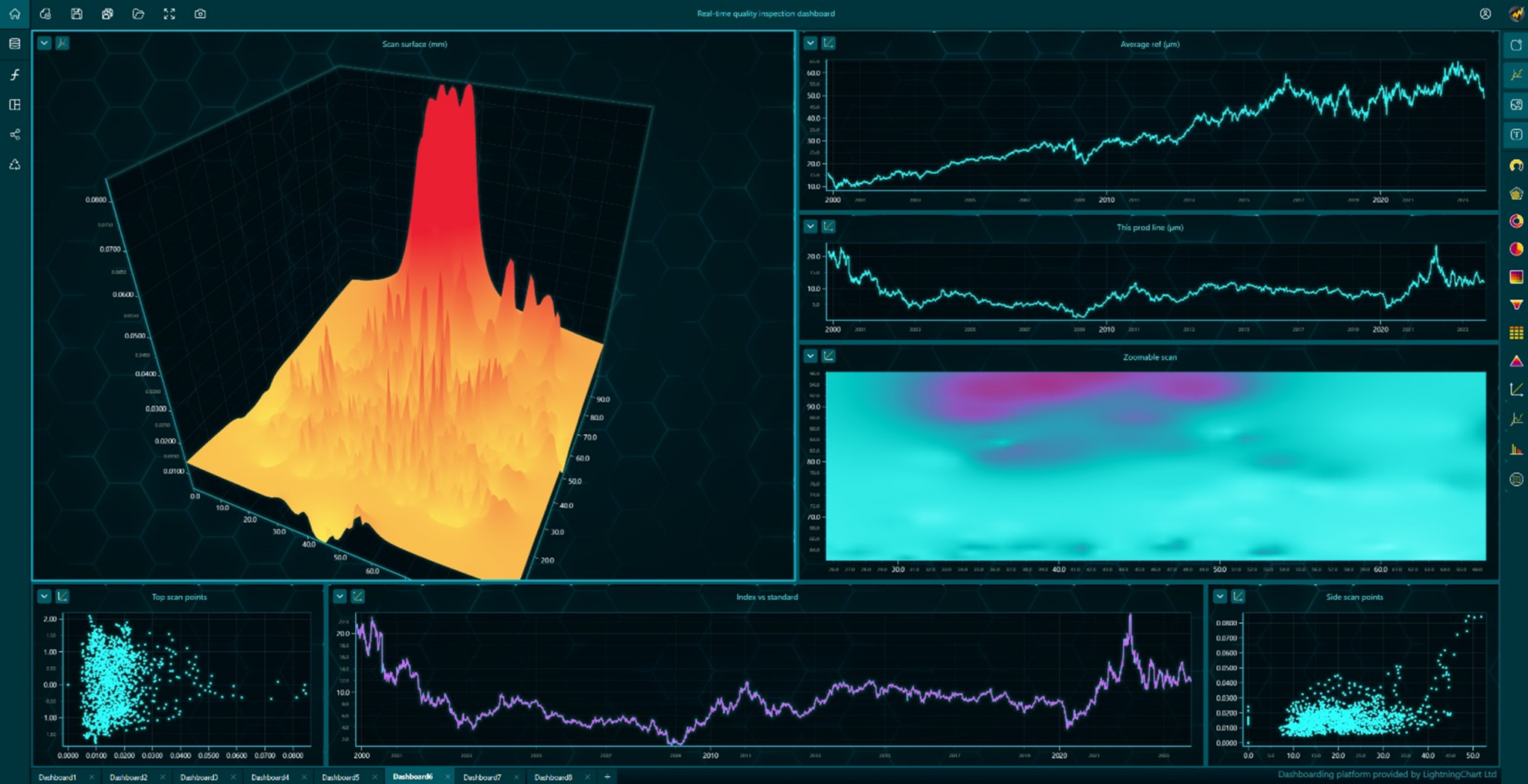

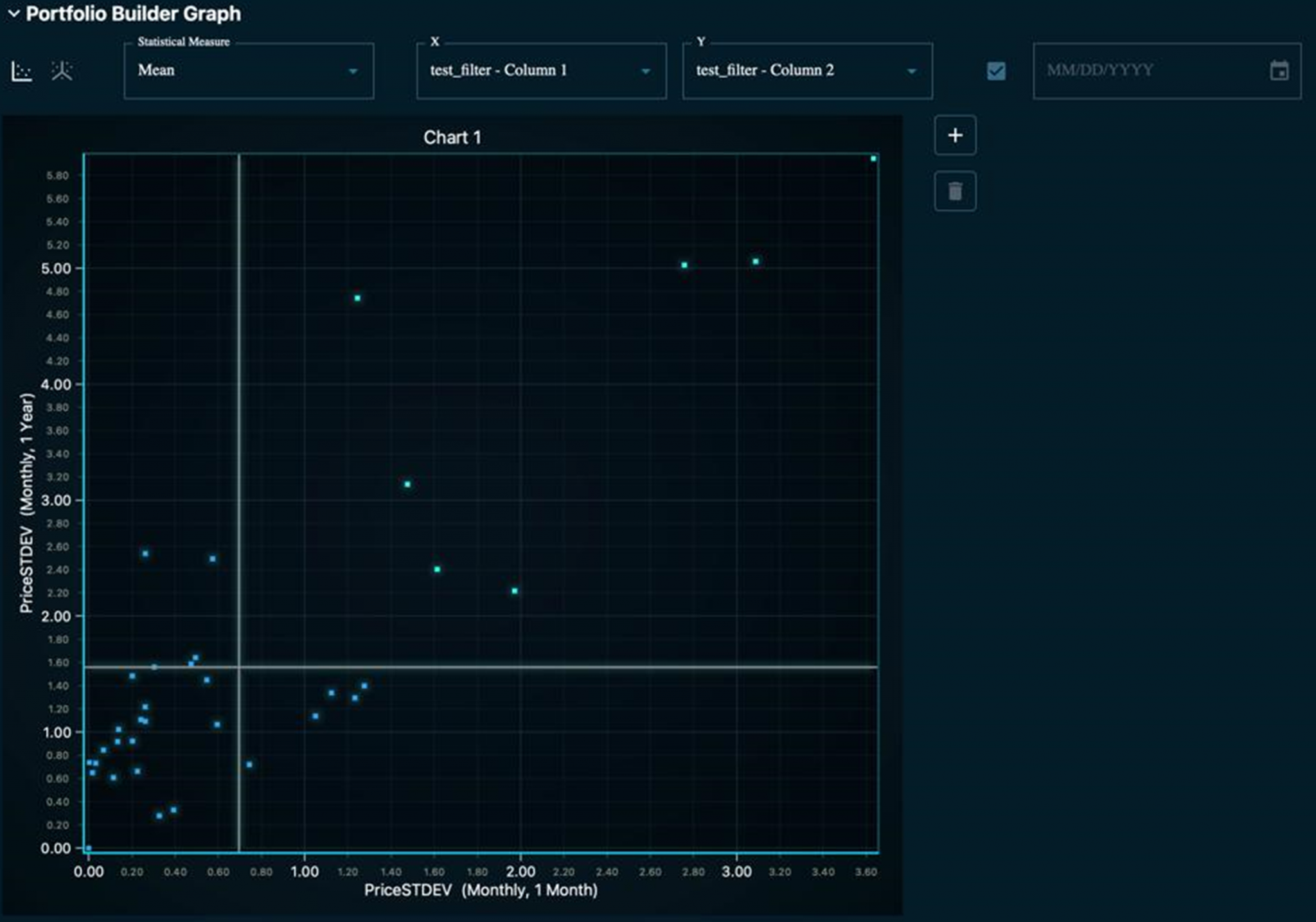

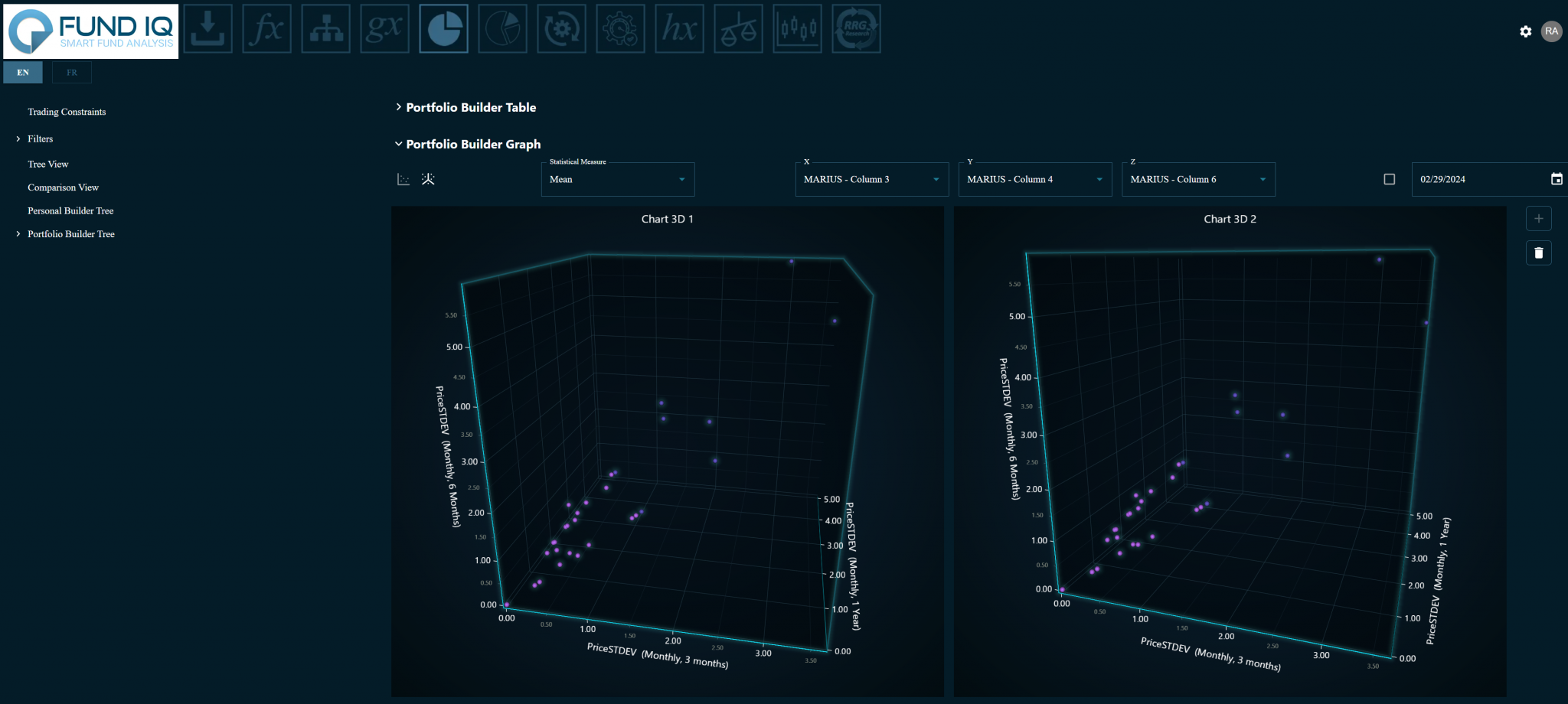

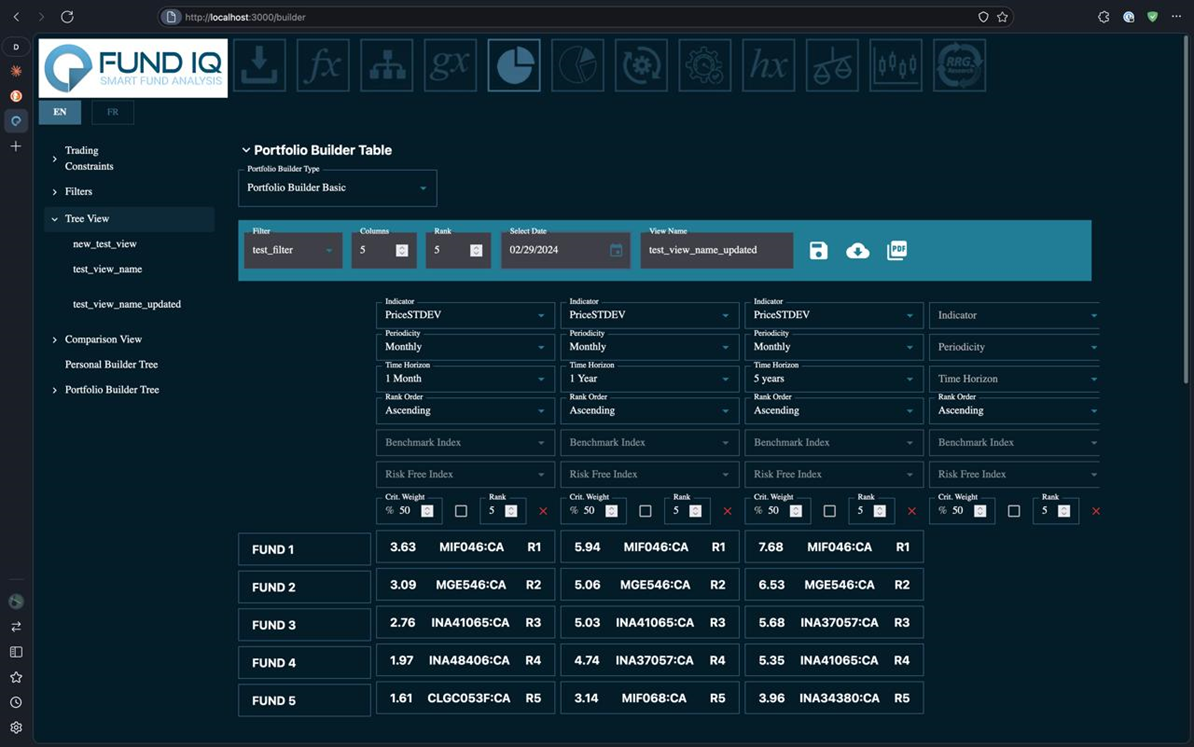

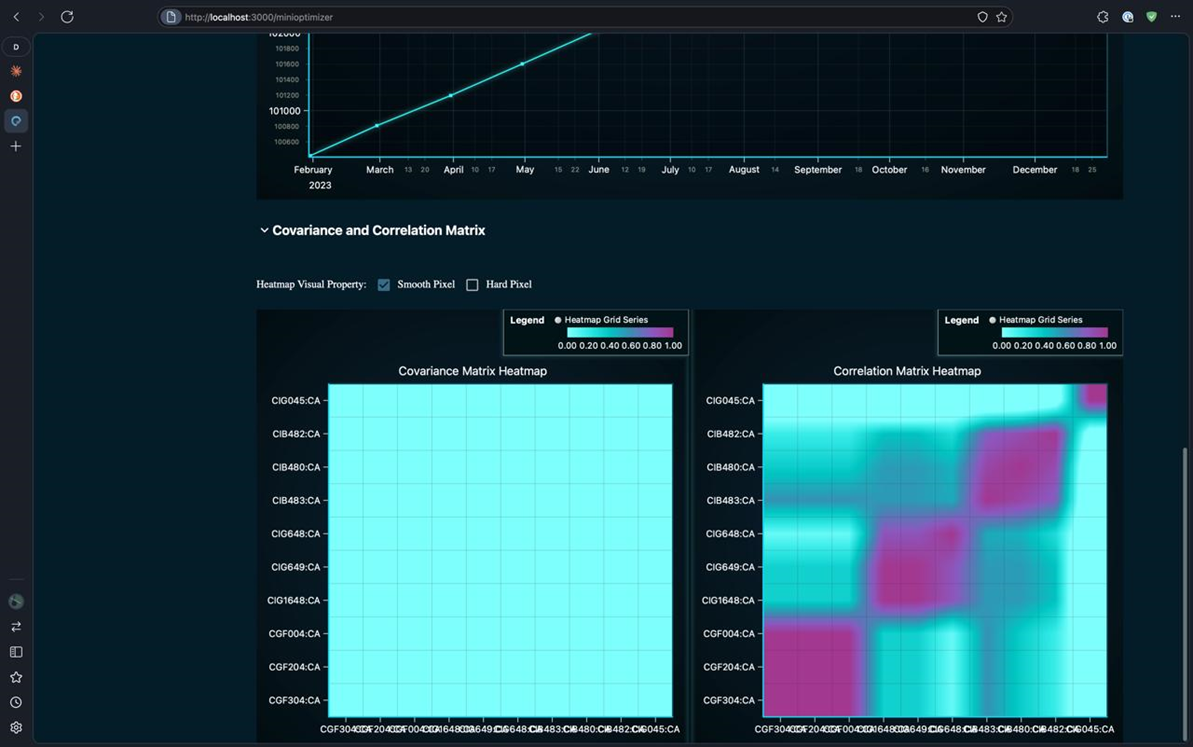

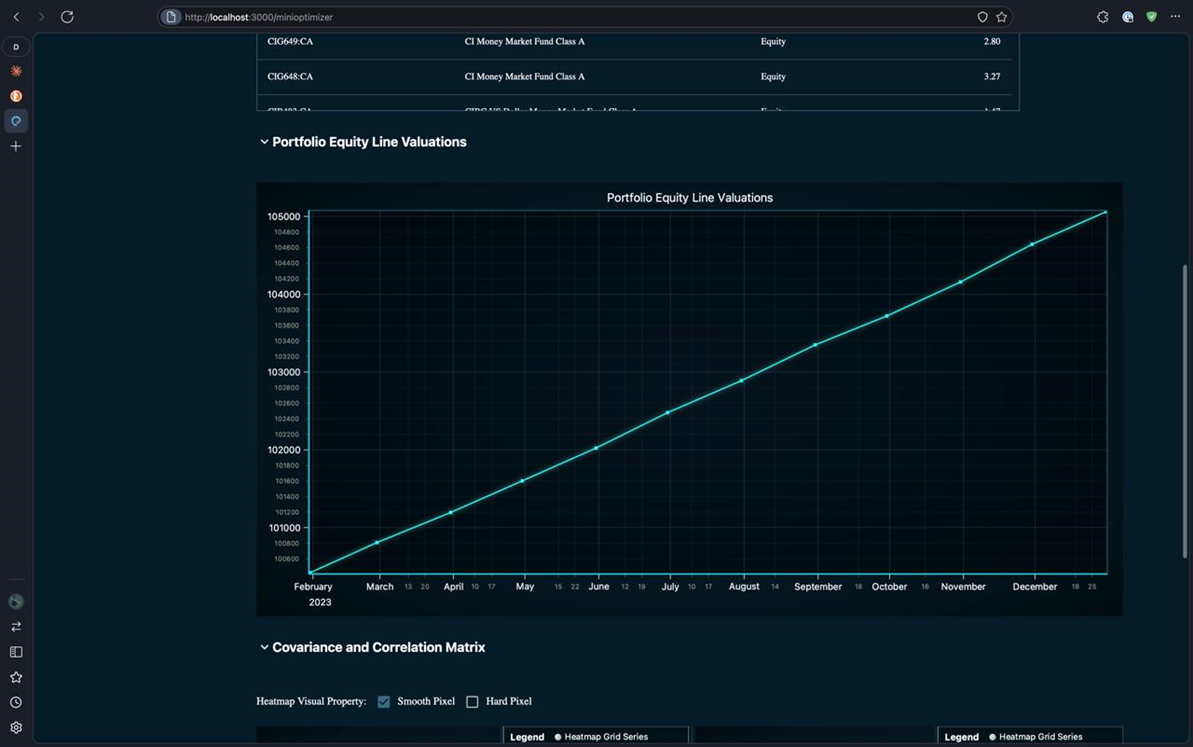

Technology-driven Managed Portfolio Solutions

Our segregated funds model portfolios represent our entry-level portfolio management solutions in support of insurance advisers and their clients.

Each model portfolio we build for our clients is built assuming specific investment and / or fund availability constraints and is optimized according to multiple criteria. In fact, each portfolio optimization becomes a model portfolio itself.

Outsourced CIO

Modern Technology, IT Services – and a full cycle of KYP compliance

With a fully personalized touch in meeting specific investment objectives or constraints or even in addressing issues of available liquidity, the outsourced CIO service provided by our investment management partner, ST Global Asset Management, proposes customized portfolio solutions that are driven by complete investor-focused. The Outsourced CIO is meant to bridge the gap between idealized / “standardized” models and the implementable / deployable structures based on actual investor realities – whether that has to do with actual objectives, constraints, personal preferences or even product availability.

And of course there is more to explore.

Other noteworthy features are:

And adding every month

who trust our products

You got any issues? Get in touch!